The company’s governing bodies are: Supervisory Board, Management Board and General Meeting of Shareholders. Competence scopes and codes regulating the operations of the governing bodies are detailed in the organization’s Statutes available on www.agora.pl.

TRANSPARENT TO SHAREHOLDERS

Agora is committed to transparency and equal access to information. These principles are applied in relations with all stakeholders, by providing them with relevant to their needs information about the company.

- APPROACH TO MANAGEMENT

- 20 years on the capital market

- CORPORATE GOVERNANCE

- TRANSPARENCY AND REPORTING

- NON-FINANCIAL RISKS

- RISK MANAGEMENT POLICY

- Other information

Choose a topic:

Transparency and clarity are the main principles of our communications. As a public company, Agora is obliged to comply with a number of regulations specifying how we inform the public about the company and its operations. To this end we ensure that all stakeholders have equal access to information and develop diverse communication tools.

We make every effort to ensure information confidentiality and its proper dissemination inside the organization. To this end we observe the principles of corporate governance and reporting as specified by the regulator.

Agora S.A. is listed on Warsaw Stock Exchange, in indices: WIG, sWIG80, WIG-MEDIA and the RESPECT Index (from 18 Dec. 2017 to 31. Dec. 2019) on the main market, in continuous trading in the Media sector. The company debuted on WSE on 20 April 1999.

As a public company we observe all rules and codes regulating the provision of information.

Over 20 years of Agora’s presence on the capital market, the company received a number of prizes and distinctions – domestic and international.

1999

20 April 1999 Agora debuts at Warsaw Stock Exchange

1999

World Economic Forum grants Agora the title of Emerging Market Leader

2000

Agora among eight global companies awarded by International Shareholder Services for excellent management of a public company in 2000

2000

Agora in top twenty on Forbes list of 300 best global SME brands

2001

Agora on Financial Times list of top 20 Eastern European brands, based on companies’ market value

2001

11th Economic Forum in Krynica names Agora CEE Company of 2000

2001

President of Agora, Wanda Rapaczyńska ranks 11 on The Wall Street Journal Europe list of 30 most influential women in business in Europe

2001

Agora among top 20 businesses with the highest net profit dynamics in 1998-2000, in ranking delivered by IBnGR for BusinessWeek/Polska

2001

Agora among top 20 businesses with the highest net profit dynamics in 1998-2000, in ranking delivered by IBnGR for BusinessWeek/Polska

2002

Agora distinguished in Central & Eastern Europe Awards 2002 contest of Investor Relations Magazine, in two categories: 'best investor relations corporate site in Central and Eastern Europe’ and ‘best investor relations in Poland’

2002

in a survey delivered by Pentor Institute for Puls Biznesu daily among 150 experts – capital market analysts, investment consultants and brokers, among 202 Polish listed companies Agora topped the ‘investor relations’ category

2003

IR Magazine award for the best investor relations in Poland

2003

WarsawScan 2003 award for the best investor relations among Polish listed companies

2004

IR Magazine award for the best investor relations in Poland and investor relations manager in Central and Eastern Europe

2004

Agora named Trustworthy Company by Polish Institute of Directors

2004

Agora receives Bull& Bear Award of Warsaw Stock Exchange Parkiet daily for the highest standards of corporate governance

2005

Agora named Trustworthy Company by Polish Institute of Directors

2005

Agora rated A in corporate ranking of Polish Corporate Governance Forum (PFCG) and Rzeczpospolita daily

2005

WarsawScan 2005 award for the best investor relations among Polish listed companies

2005

Agora among the best listed companies in a survey delivered by Pentor Institute for Puls Biznesu

2005

Agora receives another award of IR Magazine for the best investor relations in Poland in category IR Magazine Continental Europe Awards

2005

Agora as Poland’s first company outside the financial industry receives ACCA Certification (Association of Chartered Certified Accountants), one of the most prestigious distinctions for employers, recognizing the quality of professional training and development opportunities offered to employees. In 2005 only five Polish firms were holders of ACCA Certificate

2006

Agora named Trustworthy Company by Polish Institute of Directors

2007

Agora receives Bull& Bear Award of Warsaw Stock Exchange Parkiet daily for the highest return among WIG20 companies in 2007

2008

Agora’s 4Q2008 report among the top best quarterly reports among companies in WIG20 index, in the ranking of Gazeta Giełdy Parkiet. Agora ranked third in the category of reports with additional presentations and explanations. Analysts rated the quarterly report of Agora the record nine (out of ten points)

2010

Agora tops the ranking of the best managed companies in Media and Communications in the ranking of Euromoney

2011

Agora awarded in the Euromoney ranking of The Best Managed CEE Companies 2011 (the most cohesive strategy – winner in Media and Communications industry, runner-up in the category of the highest standards of corporate governance, ranked fourth for the most transparent financial reporting)

2013

Agora chosen as Poland’s best for adhering corporate governance rules and was listed in the global report Corporate Governance Report”

2016

Agora distinguished in the Pearl of Polish Economy ranking of Polish companies organized by Polish Market magazine and Collegium of Economic Analysis of Warsaw School of Economics. Agora was recognized in the Big Pearl category

2017

Agora S.A. debuts in Warsaw Stock Exchange RESPECT Index of socially responsible companies

2018

Agora wins Polish Association of Listed Companies Golden Website contest in categories Best IR Service and Leader of Online Communications

2018

Agora S.A. in Warsaw Stock Exchange RESPECT Index of socially responsible companies

2018

Agora S.A. awarded with CSR Leaf of Polityka weekly for CSR activities

2019

distinction for Agora Group for 30 years of operations in Rzeczpospolita ranking 30 Companies for 30 Years of Democracy

2019

Agora S.A. among the winners of Transparent Company of the Year 2018, the third contest of Parkiet daily and the Institute of Accountancy and Taxes, under the auspices of Warsaw Stock Exchange

Corporate governance principles apply to AGORA S.A. and subsidiaries, in which Agora holds a majority stake. They are executed by Members of Management Board of AGORA S.A., directors of businesses and members of governing bodies (Management Board, Supervisory Board, General Meeting of Shareholders) of each entity in which Agora holds a majority stake, as well as Legal Department of the capital group.

As a public company, Agora is under obligation to inform the market about any events relevant to Agora and entities in its capital group, that might affect the investment decisions of current or potential shareholders.

PRINCIPLES APPLICABLE TO AGORA GROUP

As part of internal regulations Agora implemented: Rules of access to confidential information and Agora procedure for the circulation of sensitive information, as well as publication of dates of Agora financial statements and Regulations for making exchange transactions by persons who due to their position, they have access to confidential information and Rules of providing information to the Financial Supervision Authority (KNF) and Agora.

We ensure equal access to information. Hence all data falling under the following categories: confidential information, proprietary information, information of special importance, financial performance data and information about the results of particular projects, information about the strategy, organizational changes, motivation schemes and HR, new products or services, other corporate subjects, are protected and can only be made public in a procedure specified in Agora SA Procedure for the Circulation of Sensitive Information.

With respect to all employees of Agora Group, we take every measure to eliminate the possibility of conflict of interest or any actions that might violate the non-competition clause.

Our priorities are transparency in relations with the market, communications with shareholders and investors, as well as non-discrimination in providing access to information served in an accessible form. We make every effort to issue current and periodic reports, financial statements as well as Management Board reports on the operations of Agora and non-financial statements with proper diligence, timely and in accordance with international reporting standards. We develop and streamline channels of communication with stakeholders.

RULES OF COMMUNICATIONS

We continue to take every measure to ensure communications consistency and equal access to information about Agora as a publicly listed company. To this end we have appointed individuals to handle contacts with the media and public relations communications, including the Corporate Communications Department. Employees and collaborators should not contact the media and pass any information about the company, comment Agora’s business operations, also in their capacity as a private individual. Our information policy is determined by: General principles of contacts with the media for the employees and collaborators of Agora Group.

The Management Board of Agora S.A. may comprise of three to six people. The Management Board operates on the daily basis according to the rules set out in the Company's Statute and its By-laws. Members of the Management Board meet regularly at least once a week on formal sessions. All decisions of the Management Board are made collectively. However, each member of the Management Board personally manages relevant areas of the Group's operations. In 2019 Management Board of Agora S.A. had five members.

MANAGEMENT BOARD OF AGORA S.A. IN 2019

- Bartosz Hojka – President of Board,

- Tomasz Jagiełło – Member of MB,

- Agnieszka Sadowska – Member of MB,

- Anna Kryńska-Godlewska – Member of MB,

- Grzegorz Kania – Member of MB,

The composition of the Management Board has did not change until the publication date of the report – 13 March 2020.

BY-LAWS OF ORGANIZATION AND FUNCTIONING OF THE MANAGEMENT BOARD

Operating principles of Management Board of AGORA S.A. are specified in By-laws of Organization and Operation of the Management Board – a document that specifies all rules and mode of operations of Management Board of AGORA S.A.

The Supervisory Board consists of minimum five and maximum six members. The rules governing the Supervisory Board's activities are set in details in the Company's Statutes.

supervisory board of AGORA S.A. until 12 June 2019:

- Andrzej Szlęzak – Chairman of the Supervisory Board

- Wanda Rapaczynski – Member of SB

- Dariusz Formela – Member of SB

- Tomasz Sielicki – Member of SB

- Andrzej Dobosz– Member of SB

- Maciej Wiśniewski – Member of SB

Supervisory board of AGORA S.A. since 12 June 2019:

- Andrzej Szlęzak – Chairman of the Supervisory Board

- Tomasz Karusewicz – Member of SB

- Dariusz Formela – Member of SB

- Wanda Rapaczynski – Member of SB

- Tomasz Sielicki – Member of SB

- Maciej Wiśniewski – Member of SB

The composition of the Supervisory Board did not until the publication date of the report – 13 March 2020.

THE INDEPENDENCE CRITERIA FOR SUPER MEMBERS OF SUPERVISORY BOARD

Members of Supervisory Board represent various areas of knowledge and have extensive professional experience, which allows them to view operations of the company and Agora Group at large from a broader perspective. Members of Supervisory Board are able to devote necessary time to fulfil their duties. Pursuant to the provisions of the company's statutes, at least half of the board members will meet the independence requirements set out in § 20, section 4. All members of the Supervisory Board of Agora S.A. meet the criteria of an independent Member of the Supervisory Board indicated in § 20, section 4 of the Company Statutes.

In accordance with their statements, the following Members of the Supervisory Board of Agora SA: Andrzej Szlęzak, Andrzej Dobosz, Dariusz Formela, Tomasz Sielicki, Maciej Wiśniewski, meet the independence criteria of a member of the Supervisory Board, defined by the European Commission in Annex II to the European Commission Recommendation 2005/162 / EC of on February 15, 2005 regarding the role of non-executive or supervisory directors of listed companies and committees of the (supervisory) board.

In line with the Code of Good Practices of WSE Listed Companies, at least two Members of Supervisory Board fulfil the independence requirement.

Members of Supervisory Board receive regular reports on all necessary information about the operations of Agora and Agora Group. Additionally, Agora provides Supervisory Board with access to professional, independent advisory services (within the financial capacity of the company) that might, as seen by Supervisory Board, be necessary to exercising effective supervision over the company.

Members of the Supervisory Board of Agora S.A. do not engage in a competitive activity against Agora SA. and they do not participate in a competitive company as a partner in a civil law partnership, partnership or as a member of the competitive body of a capital company or a member of the body of any competitive legal entity. They are not entered in the Register of Insolvent Debtors maintained pursuant to the Act on the National Court Register, nor have they been sentenced by a valid judgment for offenses specified in the provisions of the Penal Code and the Commercial Companies Code. Members of the Supervisory Board of Agora S.A. did not perform managerial or supervisory functions in entities which were in bankruptcy or liquidation during their term of office, were not deprived by the bankruptcy court of the right to run a business on their own account and as a member of the supervisory board, representative or proxy in a commercial company, state enterprise, cooperative, foundation or association.

COMMITTEE AND COMMISSION ESTABLISHED WITHIN THE SUPERVISORY BOARD

There is one committee and one commission operating within the Supervisory Board: Audit Committee, and Human Resources and Remuneration Commission established in compliance with the Company Statutes, performing advisory role to the Supervisory Board. As at the date of submission of this Report (13 March 2020), the Committee and Commission are composed of the following members:

AUDIT COMMITTEE:

- Dariusz Formela, Chairperson of the Audit Committee, an independent member of the Supervisory Board with knowledge and skills in the field of accounting acquired in the course of current professional activity,

- Tomasz Sielicki, a member of the Supervisory Board with knowledge about the business which the Company operates,

- Maciej Wiśniewski, an independent member of the Supervisory Board with knowledge and skills in the field of accounting acquired in the professional education in the Faculty of Finance and Banking at the Warsaw School of Economics and the Faculty of Finance at London Business School as well as in the course of current professional activity.

Competences and procedures of the Audit Committee were set with the By-laws of Audit Committee, is available on: www.agora.pl. The Audit Committee is responsible for monitoring financial reporting of the Company and the Agora Group, as well as financial audit activities, performing supervisory functions with respect to monitoring of internal control systems, internal audit and risk management, and performing supervisory activities with respect to monitoring the independence of external auditors. In order to exercise its powers, the Audit Committee may require the Company to provide certain information on accounting, finance, internal audit and risk management that is necessary for the performance of the Audit Committee's activities, and may examine the Company's documents.

The meetings of the Audit Committee are convened when necessary, but at least four times per year. In 2019 the Audit Committee was convened ten times. Meetings of the Audit Committee are convened by its chairman on his own initiative or at the request of a member of the Audit Committee, as well as at the request of the Management Board, internal or external auditor.

Meetings of the Audit Committee may also be convened by the Chairman of the Supervisory Board. The Audit Committee submits to the Supervisory Board its motions, positions and recommendations in time for the Supervisory Board to take appropriate actions, as well as annual and half- yearly reports on its activities in a given financial year and an assessment of the Company's situation in the areas within its competence.

HUMAN RESOURCES AND REMUNERATION COMMISSION:

- Maciej Wiśniewski - Chairperson of the Human Resources and Remuneration Commission,

- Dariusz Formela,

- Tomasz Karusewicz,

- Andrzej Szlęzak.

In accordance with the By-laws of the Human Resources and Remuneration commission (available on www.agora.pl) responsibilities of the Commission include periodic assessment of the principles of remuneration of the Management Board members and providing the Supervisory Board with appropriate recommendations in this respect, making recommendations regarding the amount of remuneration and granting additional benefits to individual members of the Management Board for consideration by the Supervisory Board. When submitting the above recommendations to the Supervisory Board, the Commission should specify all forms of remuneration, in particular the fixed remuneration, the performance-based remuneration system and severance pay. Additionally, the Committee's competencies include advising the Supervisory Board on the selection criteria and the procedures for appointing Management Board members in cases provided for in the Company's Statutes, advising the Supervisory Board on the procedures to ensure proper succession of Management Board members in cases provided for in the Company's Statutes. Meetings of the Human Resources and Remuneration Commission are held as frequently as needed to ensure its proper operation, at least once a year. Meetings of the Commission are convened by its Chairperson on his/her own initiative or at the request of a member of the Commission, Supervisory Board or of the President of the Company’s Management Board. Meetings of the Commission may also be convened by the Chairman of the Supervisory Board. The Commission submits to the Supervisory Board its motions, positions and recommendations in time for the Supervisory Board to take appropriate actions, as well as annual reports on its activities in a given financial year and an assessment of the Company's situation in the areas within its competence. Five meetings of the Commission were held in 2019.

GENDER STRUCTURE IN THE GOVERNING BODIES OF AGORA S.A.

With respect to the diversity recommendation and equal membership of women and men in the governing bodies, Management Board of Agora pointed out that they do not have influence over the selection of their members. Under the diversity policy adopted by Agora Group, the choice of candidates to any positions in the discretion of the Management Board is determined primarily by criteria such as knowledge, experience and skills necessary for filling the position. Application of this principle to all employees of Agora Group allows for a healthy functioning of the organization and embracing new business challenges.

Selection procedure for the Supervisory Board is specified in the Company’s Statutes and other relevant laws and regulations. The Company has limited influence on the composition of the supervisory body as well as its activities. The procedure of appointing Members of the Management Board is also specified in the Statues of Agora Group. Only holders of A series shares have authority to nominate candidates. In the opinion of the company, priority criteria for selecting candidates are high qualifications, professional experience in Agora Group’s core businesses and technical expertise to perform the responsibilities of Management Board Member.

Members of the Management Board have complementary experiences and skills. They are graduates of: Warsaw School of Economics, Silesian, Łódź and Edinburgh Universities, Wrocław Technical University, Warsaw Technical University, French Institute of Management, Harvard Business School (post-graduate courses), Wrocław University of Economics, School of Business of Warsaw Technical University.

It should be noted that the key aspect in the process of selecting governing executives and key managers is to ensure breadth and diversity, in particular in the area of professional experience, age, education and gender. The priorities are high qualifications and professional experience as well as expertise necessary to perform the function in question.

Gender structure in the governing bodies of agora S.A.

Gender structure in the governing bodies of agora S.A. - 2019

| Management Board | Supervisory Board | |

|---|---|---|

| As of end of year | ||

| Men | 3 | 5 |

| Women | 2 | 1 |

Gender structure in the governing bodies of agora S.A. - 2018

| Management Board | Supervisory Board | |

|---|---|---|

| As of end of year | ||

| Men | 3 | 5 |

| Women | 2 | 1 |

General Meeting of Shareholders of Agora S.A. is convened and arranged in accordance with the procedure and the rules provided for in the Commercial Companies Code, inter alia it approves the Company's financial statements decides about profit distribution or covering the loss, approves the performance of the members of the Company's governing bodies. The rules regarding the general meeting of shareholders are described in detail in §§ 13 - 17 of the Company's Statutes and the By-laws of the general meeting of shareholders (available on www.agora.pl). The Company informs about the dates of the consecutive general meetings of shareholders according to the law regulations, i.e. by the means of the regulatory filing.

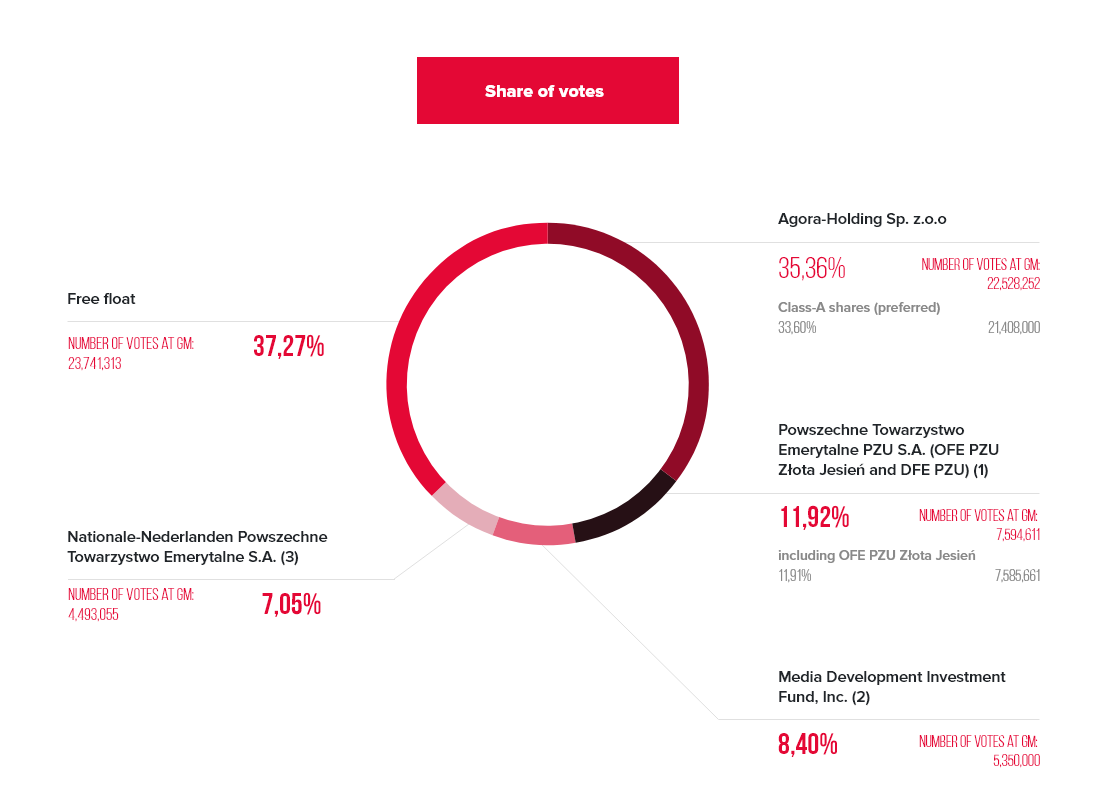

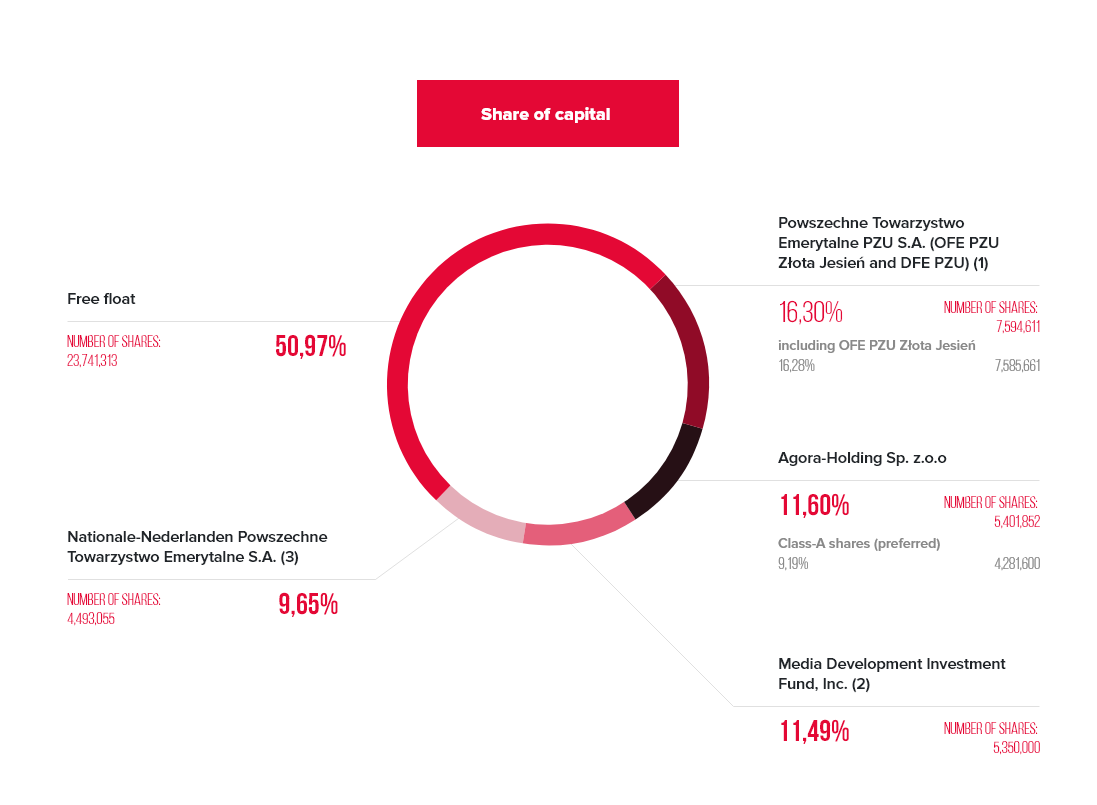

According to the formal reports from shareholders, in particular under Article 69 of the Act of 29 July 2005 on Public Offering, Conditions Governing the Introduction of Financial Instruments to Organized Trading and Public Companies, as of the day of the report the following shareholders were entitled to exercise over 5 percent of voting rights at the General Meeting of the Company.

Ownership structure

(1) number of shares according to the shareholder’s notification – as at 27 December 2012

(2) as in formal notification of 6 June 2016

(3) as in formal notification of 9 June 2016

As at 15 December 2017

*proportion of voting rights and percentage of share capital of Agora S.A. were recalculated by the Company after registration of the reduction of Company’s share capital on 23 August 2018.

Management Board of AGORA S.A. holds no information about contracts that might affect the distribution of shares among current shareholders in the future.

Agora fully recognizes the importance of the corporate governance rules and their role in enhancing the transparency of public companies. The company is therefore committed to observing them in day-to-day operations. The company makes every effort to ensure proper communications with investors and shareholders and a transparent information policy. We have also adhered to the code of best practices of companies listed on Warsaw Stock Exchange since the first edition of Code of Best Practice for WSE Listed Companies in 2002.

REPORT AND ANNOUNCEMENT ON THE ADHERENCE TO CORPORATE GOVERNANCE PRINCIPLES

Agora S.A. issues reports and announcements on the adherence to corporate governance principles by Agora S.A. The document includes information about: compliance with the good practices code of WSE listed companies as well as internal controls and risk management rules, policy of remuneration of key managers, diversity policy and social and sponsoring activities policy in Agora.

The announcement and report on the adherence to corporate governance principles by Agora S.A. in 2019 can be found on: www.agora.pl.

Every year Supervisory Board reports on their operations in the current financial year. 2019 report included information about: composition of Supervisory Board and its committees, fulfilment by Members of SB of the independence requirement, number of meetings of SB and its committees in the reporting period and self-assessment of SB’s performance. Supervisory Board also submits their evaluation of the fulfilment by the company of the WSE corporate governance code and regulations regarding submitting current and periodic information by issuers of securities, as well as evaluation of the rationality of the company’s sponsoring, charity and similar activities, or information about the absence of such policies.

In the event of any relations of a SB Member with a shareholder owning more than five percent of total shares, they are obliged to inform Members of Management Board and other Members of Supervisory Board about the fact. The same obligation applies in the event of an existing or potential conflict of interests.

RECOMMENDATIONS FOR BEST PRACTICE FOR LISTED COMPANIES

In terms of the information policy pursued, the Company complies with the recommendations by providing anyone interested with an easy and non-discriminatory access to information through a variety of communication tools. The Company operates a corporate website and publishes on it, in a legible form and in a separate section, information required under the legislation and detailed rules of the Code of Good Practice, as well as other corporate documents aimed at presenting the Company's business profile as broadly as possible to all interested parties. Although Agora S.A.’s shares are not qualified for the WIG20 and mWIG40 indices, the Company provides all the above information and documents also in English.

In addition, the Company operates a mobile version of the investor relations service and Agora's press office, as well as the Company's Twitter account, thus ensuring access to information on an ongoing basis. The Company ensures direct and personal contact with employees of the Investor Relations Department and representatives of the Company's Management Board. The Company also offers a subscription to the corporate newsletter containing selected corporate information or press releases. Additionally, the Company is engaged in industry-focused mailing activities, providing reports on individual media segments. On its website, the Company also publishes reports on compliance with corporate governance rules and information on the policy for changing the entity authorized to audit financial statements. Where the Company becomes aware that untrue information is disseminated in the media, which may significantly affect its evaluation or image, the Management Board of the Company, as soon as such information is known, decides how to respond to such information in the most effective way – whether by publishing a statement on the Company's corporate website or by using other, selected solutions, where such solutions are considered more appropriate due to the nature of the information and the circumstances in which such information is published.

The Company makes every effort to prepare and publish periodic reports as soon as possible after the end of a reporting period, taking into account the complexity of the Company's capital structure. The Management Board of Agora S.A. regularly meets with representatives of the capital market and the media at meetings held after the publication of quarterly results. These meetings are also broadcast online so as to enable all those who could not appear personally to follow the course of such a meeting, as well as to ask questions by e-mail.

The Company's Management Board and Supervisory Board act in the interest of the Company. The Management Board and the Supervisory Board have members who represent high qualifications and experience.

Serving on the Management Board of the Company is the main area of the professional activity of Management Board members. The division of responsibilities for individual areas of the company’s activity among Management Board members is published by the Company on its corporate website. As part of the division of duties between members of the board in 2019, one of them also served as the president of the management board of the subsidiary Helios S.A., which is part of the business segment directly supervised by him. It is currently the largest enterprise in the scale of the Group. In the opinion of the Management Board, this supports the effective implementation of the development plan of the Movies and Books segment, as well as the entire enterprise of the issuer.

The Company's Supervisory Board has no control over the selection of candidates to the Management Board of the Company. Candidates for members of the Management Board are nominated by shareholders holding series A shares, while the Management Board members are appointed by the General Meeting (with the reservation that Management Board members may be co-opted in accordance with the Statutes). Nevertheless, when assessing the performance of individual members of the Management Board after the end of each financial year, the Supervisory Board discusses the professional plans with each of the Management Board members in order to ensure efficient operations of the Management Board.

Members of Agora’s Supervisory Board represent diversified fields of expertise and many years of professional experience allowing them to look at issues related to the Company's and the Group's operations from a broader perspective. Supervisory Board representatives are able to devote the time necessary to perform their duties. If a Supervisory Board member resigns or is unable to perform his or her duties, the Company immediately takes steps necessary to ensure substitution or replacement on the Supervisory Board, provided that members of the Supervisory Board are appointed by the General Meeting. In accordance with requirements of the Code of Best Practice, at least two members of the Supervisory Board meet the criteria of being independent.

Members of the Company's Supervisory Board receive all necessary information on the Company's and Group's operations on an ongoing basis. In addition, the Company allows its Supervisory Board to use professional and independent advisory services (taking into account the Company’s financial position) necessary for the Supervisory Board to exercise effective supervision in the Company.

The Supervisory Board of Agora did not depart from any of the Good Practices applied by members of the supervisory boards. As part of its responsibilities, the Board prepares a brief assessment of the Company’s standing, including an evaluation of the internal control, risk management and compliance systems and the internal audit function. The aforesaid assessment covers all significant controls, in particular financial reporting and operational controls. This assessment is published by the Company together with all materials related to the general meeting on the Company's corporate website.

At the same time, the Supervisory Board reviews and issues opinions on matters to be discussed at the general meeting. Representatives of the Supervisory Board always participate in the General Meeting in a composition enabling them to answer any questions from shareholders, to the extent permitted by the applicable law. In 2019, the Supervisory Board was represented at the General Meeting by its Chairman, Mr. Andrzej Szlęzak.

Each year, the Supervisory Board also prepares a report on its activities in the financial year. The Board will also prepare the report on its activities in 2019. This report will comprise information on: composition of the Board and its Committees, the Board members’ fulfilment of the independence criteria, number of meetings of the Board and its Committees in the reporting period and self-assessment of the Supervisory Board's performance. The Supervisory Board will also present its assessment of the company’s compliance with the disclosure obligations concerning compliance with the corporate governance principles defined in the Exchange Rules and the regulations on current and periodic reports published by issuers of securities, as well as an assessment of the rationality of the company’s policy for sponsorship, charity or other similar activities or information about the absence of such policy.

Where there is any relationship between a member of the Supervisory Board and any shareholder who holds at least 5% of the total vote in the company, such member notifies the Company’s Management Board and other members of the Supervisory Board of this fact. On September 5, 2019, Mr. Tomasz Karusewicz, acting on the basis of detailed principle II.Z.5 of the Good Practices of WSE Listed Companies 2016 (hereinafter: "DPSN 2016") submitted a declaration of non-compliance with the independence criteria indicated in principle II.Z.4 DPSN 2016, which makes the criterion of compliance with independence, in particular, subject to: (i) meeting the requirements set out in Annex II to the European Commission Recommendation 2005/162/EC of February 15, 2005 regarding the role of non-executive or supervisory directors of listed companies and board committees (supervisory) and (ii) compliance with the requirement of being unrelated to a shareholder holding at least 5% of the total number of votes in the company. Bearing in mind the connection of Mr. Tomasz Karusewicz with Universal Pension Company PZU SA, i.e. a shareholder holding over 5% of votes at the general meeting of Agora SA, the Supervisory Board of the Company adopted on September 5, 2019, Resolution No. 4, in which Mr. Tomasz Karusewicz was found not to meet the abovementioned independence requirements. The same happens in the event of a conflict of interest or the possibility of its arising. The same applies if there is a conflict of interest or a potential conflict of interest.

CODE OF BEST PRACTICES FOR WSE LISTED COMPANIES

Agora S.A. complies with the corporate governance code set out in the document Code of Best Practice for WSE Listed Companies 2016 (Code of Best Practice) and observed relevant international standards. Company continued to strive for the highest standards of corporate governance and observe the principle of limited communication with the capital market in blackout periods, i.e. before the publication of Agora Group’s financial results. Agora knows and respects the regulations relevant to trading Agora’s financial instruments.

The Code of Best Practice was adopted by resolution No 26/413/2015 of the WSE Board dated 13 October 2015. The Management Board of the Company exercises due care in order to observe the principles of the Code of Best Practice. The Code of Best Practice has been published on the WSE’s website (https://www.gpw.pl/dobre-praktyki). Good Practices are grouped into six areas: information policy and communication with investors, Management Board and Supervisory Board, internal systems and functions, General Meeting of Shareholders and relations with shareholders, conflict of interests and transactions with affiliated entities, remuneration. The document contains: 20 recommendations (R) and 70 detailed guidelines (Z).

In 2019, the Company complied with all rules set out in the Code of Best Practice. The recommendation on providing shareholders with the possibility to participate in general meetings using electronic communication means (IV.R.2), as regards enabling shareholders to participate through real-time bilateral communication where shareholders may take the floor during a general meeting from a location other than the general meeting, was complied with by means of a dedicated e-mail address.

Agora has provided real-time broadcasts of General Meetings of Shareholders in Polish and English. In 2019 Agora provided shareholders with the channel for real-time two-way communication through a dedicated e-mail address. Due to significant financial and technological considerations, as well as potential legal barriers, Agora does not offer shareholders the opportunity to execute, personally or via a proxy, the right to vote in GAM via electronic channels.

AGORA S.A. IN RESPECT INDEX

From 2017 until 31 Dec. 2019 Agora S.A. was included in RESPECT Index of Socially Responsible Businesses of Warsaw Stock Exchange. WSE announced the 12th RESPECT report on 12 December 2018. In 2019 WSE announced the intention to withdraw from publishing RESPECT index on 31 Dec. 2019.

In an official notice addressed to the capital market, WSE stated that after ten years, RESPECT Index fulfilled its educational purpose and drew the attention of issuers and the entire capital market to the benefits from conducting operations in a socially and environmentally responsible manner. On 3 September 2019 WSE launched WIG-ESG. The new index includes all companies from WIG20 and mWIG40, their weights will depend on the number and value of free-float shares, but these will be adjusted for ESG ratings and an assessment of compliance with the principles laid down in Best Practice for WSE Listed Companies 2016. Additionally, since the first publication, WIG-ESG has become a base for a passive fund launched by NN Investment Partners TFI.

Due to the fact that Agora S.A. is not listed in the main indices WIG20 and mWIG40, as of the day of the publication of this report, it has not been listed on WIG-ESG.

Inclusion in RESPECT Index is a proof of Agora’s commitment to ESG aspects (Environmental, Social and Governance). RESPECT Index was the first index of responsible companies created in Central and Eastern Europe. The project was launched by Warsaw Stock Exchange in 2009 when the first portfolio was published. RESPECT includes both Polish and foreign companies listed on the WSE Main Market with than the market average expressed in the WIG index. RESPECT companies were selected from those listed at the WSE Main Market, with highest trading liquidity, included in the following indices: WIG20, mWIG40 and sWIG80. After completion of the three-step validation process carried by Warsaw Stock Exchange and Polish Association of Listed Companies, the new list of RESPECT brands was compiled, with companies whose market communications are impeccable, conducted through current and periodic reports and their corporate websites. The third condition was socially responsible behaviour towards the environment, community and employees, analysed on the basis of a questionnaire verified by the project auditor.

Shares of companies in the index were calculated following the same principle as the other WSE indices, on the basis of the number of free-floating shares, with the share of major companies in the index capped at 25 percent when the RESPECT had fewer than 20 underlying companies and to 10 percent when the number exceeded 20. More on: http://www.odpowiedzialni.gpw.pl

COMMUNICATION WITH CAPITAL MARKETS

Communications of AGORA S.A. with all stakeholders, including investors, analysts, shareholders and other members of the capital markets is of crucial importance and is always conducted with transparency and integrity. Agora regularly organizers meetings for investors, shareholders and the media, with presentations of the group’s financial results. At least four such meetings for investors and journalists are held each year. To provide equal access to information, Agora streams the reporting sessions with simultaneous translation to English, On-site as well as online participants can join Q&A session with the members of Management Board of Agora.

The same formula applies also to ordinary and extraordinary General Meetings of Shareholders that are announced in advance, to allow time for proper preparation for shareholders before meeting representatives of Agora.

Additionally, at least once a year representatives of the capital market and the media are invited to participate in Agora Open Day, when they can interview managers of the group’s businesses.

Members of Management Board and Investor Relations regularly attend domestic and foreign conferences and other events organized by sell side, sharing information about the company, market segments in which Agora operates and presenting materials developed especially for this purpose. To provide better insight into the company’s situation, Agora offers analysts and investors market and industry reports and analyses as well as the possibility of face-to-face contact with the representatives of investor relations, corporate communications and the company’s Management Board.

To ensure two-way dialogue, Agora develops intuitive communication tools and offers ready access to information (newsletters, mobile website, Twitter account (@Agora SA) and LinkedIn, mailing of industry-specific reports on specific segments of the company’s operations).

Channels of communication with the market also include collecting investor feedback, through individual interviews by the members of Investor Relations team.

Investor relations are an element of building the Company’s value on the capital market. Agora stays in touch with representatives of the market and is thus viewed as one of the most transparent companies in the market. Shareholders, investors and analysts actively trace the updates from Agora. Indeed, contacts are often initiated by the stakeholders who value speedy and informative responses and the always open, wide communication channel of communication with Investor Relations of Agora.

Agora also instantly responds to all queries from stakeholders, particularly investors or the media, and monitors standard and social media.

AGORA DISTINGUISHED FOR COMMUNICATIONS WITH CAPITAL MARKET

In 2019 Agora returned to the group of winners of the prestigious Golden Website competition organized by Polish Association of Listed Companies on categories Best IR Service and Leader of Online Communications. The awards attest to high quality of Agora’s investor relations and communications with the capital market and prove high confidence in the company on the part of stakeholders.

AGORA NAMED TRANSPARENT BRAND OF 2018

Agora S.A. was among the winners of the title Transparent Company of the Year 2018. This is the third edition of the ranking organized by Parkiet daily and the Institute of Accountancy and Taxes under the honorary patronage of the Warsaw Stock Exchange. The award ceremony was held on May 20, 2019 in Warsaw.

Transparent Company of the Year 2018 ranking was based on a survey that covered following areas: financial reporting, investor relations and corporate governance principles. The companies from indexes: WIG20, mWIG40 and sWIG80 received a special questionnaire with an invitation to complete it in order to be included in the ranking. 64 companies participated in the survey - 15 from WIG20, 23 from mWIG40 and 26 from sWIG80.

Agora received the Transparent Company of the Year 2018 title for the highest number of points (32) among companies from the sWIG80 index.

The organizers of the Transparent Company of the Year 2018 ranking are: Parkiet daily’s editorial team and the Institute of Accountancy and Taxes. The honorary patron is the Warsaw Stock Exchange and the substantive partner is Wierzbowski and Partners Legal Advisors and Advocates.

Agora Group regularly monitors and evaluates risks involved in current operations. The table below presents key non-financial risks:

Measures to mitigate the above risks are discussed in relevant sections of Agora Group Responsibility Report 2019 and in the section STRATEGIC APPROACH TO CSR.

Map of non-financial risks

Key risks in this are: Agora Group actively tracks and analyses market trends and our habitat, develops regular analyses of the business environment, advertising and media markets for strategic planning of operations. Operations of Agora Group are determined by a business strategy that is monitored and regularly verified. In their licensed and other media operations, the media of Agora Group committed to complying with relevant regulations, industry standards and self-imposed internal codes. More in sections: Labour practices represent one of responsible business priorities to Agora Group. Agora takes measures to minimize the following risks in this area: Anti-discrimination and Anti-mobbing Policy and Whistleblowing System were introduced by Agora to reduce discrimination-related risks. Management Board of Agora appointed a plenipotentiary for contacts with trade unions and Anti-mobbing and Anti-discrimination Officer. Employees are consulted on all employee-related matters as they arise. Agora Code of Ethics lists principles that apply to all employees and collaborators of Agora in selected areas and contexts. More in sections: Agora Group also has internal solutions in place: policies, rules and codes, that regulate issues related to the protection of human rights. We monitor their application on a regular basis. Key risks in the area are: Anti-discrimination and Anti-mobbing Policy and Whistleblowing System were introduced by Agora to reduce discrimination-related risks. Management Board of Agora appointed a plenipotentiary for contacts with trade unions. The employees are consulted on all employee-related matters as they arise. Agora S.A. adopted Code of Conduct for Suppliers and Contractors of Agora to ensure compliance and responsibility of all suppliers and partners of Agora. Agora Code of Ethics lists principles that apply to all employees and collaborators of Agora in selected areas and contexts. More in sections: FRIENDLY WORKPLACE In the contemporary world, mass media play a vital role in informing and driving opinions. Social and economic change is accompanied by transformations in the mass media and dynamic development of social media. Challenges faced by the media industry: In their licensed and other media operations, Agora Group media are committed to complying with relevant regulations, industry standards and self-imposed internal codes. Agora Group media are committed to educating the industry and offering our journalists in-house opportunities for increasing their competences. Agora Code of Ethics lists principles that apply to all employees and collaborators of Agora in selected areas and contexts. More in sections: Due to the character of the company’s operations (predominantly services), environmental aspects are not perceived by The Agora Group as priority risk areas. Nevertheless, the company is aware of the risks associated with its operations, predominantly with the printing, cinema, food services, outdoor advertising and building administration. The main risk areas are : Agora regularly estimates and introduces measures to reduce our impact on the environment. In 2019 Management Board of Agora adopted Environmental Policy, a document that outlines the company’s approach to the management of environmental impact and applies to all employees and collaborators. It specifies Agora’s environmental impact plans. More in section: Key areas of product responsibility relevant to Agora Group are marketing communications, complaint procedures and protecting customer privacy and personal information. Key areas of risk are: Agora S.A. introduced a set of procedures for suppliers and contractors, to ensure compliance and responsibility of all suppliers and business partners of Agora. User and client satisfaction is monitored and the customer complaint system is expanded and streamlined. Agora introduced new procedures, monitors the processing of complaints and makes necessary improvements whenever necessary. Agora printing plants adopted Quality Management System to continue quality improvement through meeting the requirements and expectations of clients, while maintaining profitability increase and financial security of Agora. A set of protocols and activities was introduced for personal data protection. Agora Code of Ethics lists principles that apply to all employees and collaborators of Agora in selected areas and contexts. More in sections: Supporting local communities in all locations where the company conducts its operations and involvement in social, cultural, sports and charity projects are the key activities in the social impact area. Due to the intensity of the company’s activity in the area, the company faces the following risks: Agora Group has described its social and sponsoring policy in a document that outlines the directions and principles of the company’s activities in the area of social responsibility. Additionally, Agora introduced protocols such as Procedure of Accepting and Publishing Charity Adverts in Gazeta Wyborcza and its supplements, web services and magazines that determine how such ads are classified, verified and published. Agora S.A. adopted Code of Conduct for Suppliers and Contractors of Agora to ensure compliance and responsibility of all suppliers and partners of Agora. Agora Code of Ethics lists principles that apply to all employees and collaborators of Agora in selected areas and contexts. More in sections: Managing risk of corruption is of key importance to Agora Group. In this area primary risks are: W „Kodeksie etyki Agory” zostały wskazane główne zasady, które dotyczą wszyAgora Code of Ethics lists principles that apply to all employees and collaborators of Agora in preventing corruption and fraud. A confidentiality-based system for reporting cases of misconduct was implemented. Compliance audit was conducted to identify areas for improvement and change, also in the aspect of preventing corruption and fraud. Agora also established the post of Compliance Officer to supervise the ethics and compliance systems. More in sections:Map of non-financial risks

RISK

MAP OF RISKS

MANAGEMENT

ECONOMIC AND LEGAL RISKS

ETHICS AND COMPLIANCE

TRANSPARENCY

LABOUR PRACTICES

FRIENDLY WORKPLACE

DIVERSITY AT WORK AND IN SOCIETY

ETHICS AND COMPLIANCE

RISKS RELATED TO HUMAN RIGHTS

DIVERSITY AT WORK AND IN SOCIETY

ETHICS AND COMPLIANCE

INDUSTRY-SPECIFIC RISKS (MASS MEDIA)

Sector-specific risks:

Risk involved in conducting concession:

FRIENDLY WORKPLACE AND HUMAN RIGHTS

ETHICS AND COMPLIANCE

RELATIONS WITH CUSTOMERS, CLIENTS AND SUPPLIERS

ENVIRONMENTAL RISKS

CARE ABOUT ENVIRONMENT

RISKS RELATED TO SUPPLY CHAIN AND RELATIONS WITH CLIENTS

ETHICS AND COMPLIANCE

RELATIONS WITH CUSTOMERS, CLIENTS AND SUPPLIERS

RISKS RELATED TO SOCIAL ACTIVITIES

WORK FOR SOCIETY

CARE ABOUT ENVIRONMENT

RISK OF CORRUPTION

ETHICS AND COMPLIANCE

RELATIONS WITH CUSTOMERS, CLIENTS AND SUPPLIERS

To mitigate the above risks Agora adopts policies and regulations to optimise the organization’s management. Approach to Management sections of this report present procedures and policies developed by Agora to eliminate non-financial risks.

Agora Group has internal control and risk management systems currently in place. Agora Group has implemented a Risk Management Policy aimed at specifying the rules and framework of risk management processes and key concepts relevant to risk management. The document specifies: division of responsibilities risk management timeline; categories of risk; risk reporting: register and map of risks and acceptable risk threshold. Agora Group also developed Internal Audit Regulations and Risk Register – Map of Risks. Map of Risks is based on data from entries in Register of Risks from the year. Management Board determines key risks and repots them in the form of Map of Risks. For each key risk, the intensity of results of its occurrence is identified as well as the probability of their materialisation. Additionally, the organization determines factors that mitigate the results and the probability. For each key risk, it is determined whether the risk is sufficiently reduced, i.e. whether the degree of risk is acceptable to Agora Group. Agora Group executives perform tasks involved in internal control system and continuous supervision over its effectiveness as part of managing the Group’s businesses. Moreover, Agora Group has Internal Audit Department that preforms internal audit, as an independent entity, to objectively assess the entity’s effectiveness for generating values and optimize the operations of the audited entity or the entire Agora Group. The operations of AD are specified in Internal Audit Regulations adopted by Management Board and Auditing Committee at the Supervisory Board of Agora Group. In accordance with the best practices, Internal Audit reports to Management Board and Auditing Committee at Supervisory Board. Internal Audit Director coordinates risk management processes specified in Risk Management Policy. Following Internal Audit Regulations, on the basis of risk management results, the body develops auditing plan to be approved by Auditing Committee at Supervisory Board. A report is developed from each audit, with recommendations and guidelines for process optimisations. Auditing Committee at Supervisory Board regularly sits with Internal Audit to discuss audit reports and measures taken to mitigate existing risks, and on that basis monitor the achievement of annual internal audits plan. Nine such meetings were held in 2019 and six in 2018.

THE MAIN ELEMENTS OF THE INTERNAL CONTROL SYSTEM ARE COMPONENTS OF THE GROUP’S BUSINESS PROCESSES AND INCLUDE:

FINES OR NON-FINANCIAL PENALTIES

In 2019 w none of the entities of Agora Capital Group was subject to fines for:

- infringement of customer privacy or loss of personal data;

- non-compliance with the law and regulations or self-imposed codes regulating marketing communication, including advertising, promotion and sponsoring;

- non-compliance with the law and regulations or self-imposed codes relevant to health impact of products and services in any impact category or stage, by type of effect. Agora Group did not sell forbidden or controversial products in 2019.

In 2019 the entities of Agora Capital Group:

- did not record incidents of corruption,

- were not subject to any legal actions for anti-competitive behaviour, anti-trust, monopoly practices or their outcomes,

- were not subject to any significant fines or non-monetary sanctions for non-compliance with labour law,

- did not record incidents of breach of labour laws and was not subject to a penalty or fine resulting from a lost case against an employee or collaborator (i.e. penalty became final and the fine payable),

- not subject to any significant fines or non-monetary sanctions for non-compliance with environmental law and/or regulations.

CUSTOMER PRIVACY AND PROTECTION OF PERSONAL DATA

Two incidents occurred in 2019 in terms of infringement of customer privacy and loss of personal data. Both were caused by external factors and were reported to PDPO. In both cases Agora instantly took measures to minimize risk of breach of customer privacy or unauthorised access to data.

Agora received three formal letters from Personal Data Protection Office urging Agora S.A. to provide explanations. Agora’s timely response proved that in the relevant cases personal data was handled correctly.

In 2019 one incident was recorded in Helios S.A. resulting in a report sent PDPO. The incident was caused by an error of an employee. Measures taken to minimize the risk of confidentiality breach or unauthorised access to data were approved by PDPO.

In 2019 one incident was reported in which one of former employees of Agora exceeded his competence and could gain access to personal information of his colleagues. The investigation that ensued included analysis of risks. All employees potentially threatened by the situation were invited to a meeting and preventive measures were deployed.

Since 2015 PDPO has been investigating a case of complaint concerning the processing of personal data included in comments on an internet forum referring to the claimant. In 2019 Agora received a formal letter from PDPO stating that enough evidence had been collected for a conclusive ruling in the case. The ruling by the President of PDPO was not announced by 31 December 2019.

RESPONSIBLES FOR PRODUCTS AND SERVICES

In 2019 Foodio Concept underwent an inspection of State Trade Inspectorate (PIH) resulting in fine. No other penalties or fines were incurred by entities of Agora Group in 2019 for breaches of law or other regulations in the delivery and use of products and services.

W 2019 r. nie stwierdzono w spółkach Grupy Agora innych kar i sankcji z tytułu niezgodności z prawem i regulacjami dotyczącymi dostarczania i użytkowania produktów i usług.

ANTI-COMPETITIVE, ANTI-TRUST, MONOPOLY PRACTICES

In 2019 no cases of anti-competitive behaviour, or their outcomes were recorded. In March 2019 Office of Competition and Consumer Protection opened a formal investigation procedure regarding the sale of Eurozet. OCCP aims to establish whether Agora and SFS Ventures were under obligation to report the takeover of the publisher of Radio Zet.

Office of Competition and Consumer Protection (UOKiK - Urząd Ochrony Konkurencji i Konsumentów) launched phase two of the investigation regarding the acquisition of Eurozet by Agora. The case requires a market survey to be conducted. Application for the permission to purchase was submitted to OCCP on 28 October. The decision to initiate phase two of the procedure does not prejudge the final decision.

In 2020 OCCP announced that opening a formal investigation procedure regarding the Resolution of the City of Warsaw Council City Landscape Resolution on the rules and terms of installing street furniture and fences. According to the information posted on the website, the investigation is due to the potential monopoly of AMS S.A. that would eliminate from the market a number of advertising industry players.

The proceedings refer to the case and are not aimed at specified entities. OCCP shall investigate the OOH advertising market in Warsaw in order to understand its mechanisms, market shares of different players and economic effects of legal regulations. The office does not exclude further actions, including anti-monopoly proceedings, in the event of confirmed breach of the act on competition and consumer protection.

ADMINISTRATIVE AND COURT-ADMINISTRATIVE PROCEEDINGS

Due to the nature of Agora’s business as a newspaper publisher, the company is involved in a number of civil cases brought in relation to an infringement of the right to protection of personality in press publications. Agora is also a party to administrative and court-administrative proceedings in connection with complaints about the refusal by the company to disclose personal data of users of websites of the company to entities other than authorized bodies.

The company is also party to cases pursuant to complaints filed against the decisions of prosecutor’s office or court related to providing access to personal data of users who comment press articles on Wyborcza.pl. Agora is party to administrative and court-administrative proceedings in connection with complaints about the refusal by the company to disclose personal data of users of websites of the company to entities other than authorized bodies.

In 2019 a civil case against Agora was closed in which the plaintiff accused the company of infringement of personality rights by publishing the plaintiff’s comments on a discussion forum. The charges were dropped.